Digital loan marketing isn’t about being the loudest—it’s about building meaningful connections. With endless options online, borrowers value trust and clear communication. Banks and credit unions must move beyond traditional ads and create digital campaigns tailored to customer needs and behaviors.

Today’s borrowers often start their lending journey online, researching on Google, social media, and review sites. Financial institutions not leveraging these channels risk losing out to competitors who actively engage borrowers digitally. It’s vital to be present when borrowers search for financial solutions.

By using paid search, social media ads, content marketing, automation, and data-driven insights, banks and credit unions can stand out, build trust, and drive qualified loan applications.

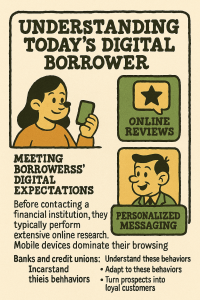

Understanding Today’s Digital Borrower

Modern borrowers are tech-savvy and demand convenience, transparency, and personalized experiences. Before contacting a financial institution, they typically perform extensive online research. Mobile devices dominate their browsing behavior, highlighting the necessity of seamless mobile experiences for all digital interactions.

Online reviews and peer recommendations greatly influence consumer decisions. Financial institutions must actively manage their digital reputation to build credibility. Additionally, personalized messaging is no longer optional—it’s essential. Consumers expect tailored interactions reflecting their unique financial situations, and generic ads won’t suffice.

Banks and credit unions that understand and adapt to these behaviors will thrive, turning prospects into loyal customers by consistently meeting borrowers’ digital expectations.

Paid Search (PPC): Capturing Intent at the Right Moment

Paid search advertising is one of the most effective ways to capture borrowers who are actively seeking financial products online. By targeting high-intent keywords such as “mortgage refinancing,” “best auto loans,” or localized terms like “Atlanta home equity loans,” financial institutions can position themselves directly in front of potential customers during critical decision-making moments. Appearing at the top of search results with relevant ads not only increases visibility but also ensures higher relevance and a greater likelihood of conversion.

However, running a successful PPC campaign involves more than just bidding on the right keywords. Crafting effective ads requires compelling, action-oriented copy, clear and transparent disclosures, and a strong call to action that encourages users to take the next step. Equally important are optimized landing pages, designed to provide a seamless user experience and convert visitors into applicants with ease. These landing pages should be fast-loading, mobile-friendly, and include concise forms or application processes to reduce drop-off rates.

Engaging Borrowers Through Social Media Advertising

Social media platforms like Facebook, Instagram, LinkedIn, and TikTok offer banks and credit unions an opportunity to meet borrowers where they spend their time. With advanced audience targeting and creative formats like carousels, reels, and stories, institutions can share borrower success stories, simplify complex loan products, and educate users in a relatable way.

Think of an Instagram reel walking through a first-time homebuyer’s experience, or a LinkedIn post from a business banker explaining small business loan options. On TikTok, short videos with voiceovers and quick visuals can break down credit score myths or promote budgeting tips that lead to loan readiness. It’s all about relevance, trust, and clarity.

Social Media Tips That Actually Work:

- Video wins attention – Social video ads average 48% more engagement than static content. Keep it short and real.

- Retargeting works – Ads shown to past website visitors can convert up to 10x more than cold impressions.

- Design for mobile – With 90%+ of users on mobile, keep visuals clean and messaging direct.

- Teach something useful – Educational content builds trust and gets shared more often, boosting visibility.

- Use smart segmentation – Narrow targeting often means lower CPC and better quality leads.

When your content feels timely, helpful, and personal, people pay attention—and take the next step in their loan journey.

Maximizing Email Marketing and Automation

Let’s talk email marketing! Email is still one of the highest-performing tools in a financial marketer’s toolkit—especially when it’s personalized and automated. Segmenting your audience based on behaviors, loan type interest, or where they are in the borrower journey makes every message feel more relevant. Whether it’s a welcome sequence for new prospects or targeted loan offers for existing customers, smart segmentation boosts engagement and conversions.

Automation takes things further, handling abandoned applications, follow-ups, and drip campaigns without manual effort. First-time borrowers benefit from educational emails that break down terms, timelines, and expectations—building trust while positioning your institution as a helpful guide. The more refined the timing, content, and cadence, the better the results.

Email Marketing Moves That Drive Results:

- Segment everything – Tailored emails see open rates up to 50% higher than generic blasts.

- Use automation wisely – Loan abandonment sequences can recover up to 40% of missed opportunities.

- Test subject lines often – A/B testing boosts open rates and gives real insight into what your audience responds to.

- Educate, don’t just sell – Informative emails build trust and position your institution as a long-term partner.

- Time it right – Well-timed reminders and offers often outperform flashy campaigns.

The right message, delivered at the right moment, can transform an inbox into a powerful touchpoint in the borrower journey. It’s not just about communication—it’s about building trust, providing value, and guiding borrowers through every step of the process with timely, relevant information.

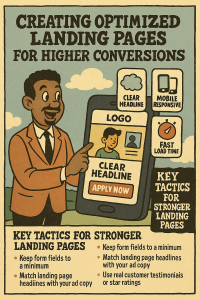

Creating Optimized Landing Pages for Higher Conversions

Landing pages are the critical bridge between your ads and conversions. When someone clicks on your ad, they arrive with a specific expectation based on what was promised in the ad. This means your landing page needs to deliver on that promise with clarity and precision. A mismatch between the two can lead to confusion and a lost opportunity. Key elements like clear value propositions, a compelling headline, and a clean, intuitive layout are essential for encouraging users to take action.

It’s not just about content, though—speed and mobile responsiveness are equally crucial. A great offer or beautifully designed page won’t matter if it takes too long to load or doesn’t display properly on different devices, especially mobile phones. Today’s users expect a seamless experience, and a slow or clunky page can drive them away before they even engage.

In addition, don’t underestimate the power of regular testing to fine-tune your landing page. Experimenting with elements like the copy, the length of forms, the wording of your call-to-action, or even the color of your CTA button can yield incremental improvements. Over time, these small changes can lead to meaningful gains in performance, boosting conversions and helping you get the most from your ad campaigns.

Key tactics for stronger landing pages:

- Keep form fields to a minimum to reduce friction.

- Match landing page headlines with your ad copy to create continuity.

- Use real customer testimonials or star ratings as trust builders.

- Include a bold, singular call to action—avoid giving multiple options.

- Optimize for fast loading on all devices, especially mobile.

All in all, a well-built landing page isn’t just a conversion tool—it’s a reflection of how easy you are to work with and the value you can offer to your audience. It demonstrates your attention to detail, communicates your brand’s professionalism, and sets the tone for a seamless user experience, building trust from the very first click.

Leveraging First-Party Data and CRM for Personalized Marketing

Your CRM is more than just a storage system—it’s the cornerstone of personalized, relevant marketing strategies. Tapping into first-party data enables banks and credit unions to create tailored experiences that resonate with their customers on a deeper level. This data allows institutions to reach out with the right message at the right moment, whether it’s a reminder to complete a loan application, a personalized HELOC offer to a current mortgage holder, or even financial tips based on a customer’s spending habits.

When your CRM integrates with marketing platforms, it creates a powerful closed-loop system. This integration uses real-time behavior to trigger targeted messaging, ensuring that every interaction feels timely and meaningful. Not only does this reduce guesswork in campaign planning, it also leads to stronger customer relationships and increased engagement.

However, leveraging data responsibly is critical. All data use must comply with privacy regulations such as GDPR or CCPA, which safeguard customer information and reinforce trust. Aligning your strategies with these laws demonstrates a commitment to transparency and building long-lasting customer confidence. Personalized marketing isn’t just about selling—it’s about fostering genuine connections through smart, thoughtful use of data.

Practical CRM-based strategies:

- Identify inactive borrowers and re-engage them with timely offers.

- Send targeted product recommendations based on account history.

- Trigger application reminders automatically after page visits or form starts.

- Track interactions across channels to deliver more consistent messaging.

Using your own customer insights to inform marketing doesn’t just improve ROI—it creates a more helpful, relevant experience for every borrower.

Building Trust Through Strategic Content Marketing

Borrowers often feel overwhelmed when facing important financial decisions, and this is where content marketing can become a powerful trust-building tool. By providing clear, unbiased, and actionable resources, your institution can position itself as a trusted advisor and guide, rather than just a lender. Whether it’s a blog post breaking down the pros and cons of refinancing, a step-by-step video explaining the pre-approval process, or an FAQ section addressing common concerns, content has the unique ability to educate, reassure, and ultimately convert potential borrowers.

Beyond fostering trust and engagement, high-quality content plays a crucial role in driving organic visibility. Educational pieces that rank well in search engines for keywords like “how to apply for a personal loan” or “auto loan credit requirements” bring in traffic from individuals who are already searching for services like yours. It’s not just about answering their questions—it’s about being there at the precise moment they need guidance, with the right information that helps them move forward confidently.

Content approaches that build credibility:

- Write explainer articles: Address common borrower questions such as “What’s the difference between fixed and variable rates?” or “How does credit impact loan eligibility?”

- Develop interactive tools: Create helpful tools like loan calculators, rate estimators, or even repayment trackers that give users personalized insights they can act on.

- Localize your content: Cater to specific community needs by highlighting local financial trends, regional home-buying tips, or programs designed for certain demographics.

- Share short, digestible videos: Simplify complex topics like loan underwriting or debt-to-income ratios with engaging, easy-to-follow videos.

Additionally, diversifying your content portfolio to include webinars, case studies, and customer testimonials can further enhance credibility and trust. Borrowers who see relatable examples of others navigating similar financial journeys are more likely to feel confident in your institution’s expertise.

Great content answers immediate questions and gives people a reason to return to your platform time and time again. Building this trust over time allows your institution to become the go-to resource for borrowers when they’re ready to make pivotal financial decisions. Strategic, educational content isn’t just a marketing tool—it’s an investment in long-term relationships with your audience.

Tracking Digital Marketing Success and ROI

Performance tracking is one of the most overlooked, yet critical, elements in any digital loan marketing strategy. Banks and credit unions can’t afford to rely on guesswork—especially when budgets are tight and acquisition costs are rising. Understanding how each channel contributes to lead generation, loan application starts, and final approvals gives marketers the power to focus resources where they matter most.

Platforms like Google Analytics, Meta Pixel, and Tag Manager make it possible to follow the borrower’s journey from initial click to conversion. But it’s not just about collecting data—it’s about connecting the dots. When you can see which ads drive real applications (not just impressions), which emails lead to form submissions, or which landing pages drop off traffic, your entire strategy becomes sharper. The key is to track what matters, not just what’s easy to measure.

What to measure and how to use it:

- Track cost-per-lead (CPL), cost-per-click (CPC), and cost-per-funded-loan to evaluate true campaign ROI.

- Use Google Analytics goals to monitor high-value actions like completed applications or rate calculator usage.

- Implement UTM tracking to tie specific ads or creatives back to performance metrics.

- Conduct A/B testing to refine subject lines, CTAs, visuals, and copy across email and paid ads.

- Build dashboards to report performance weekly and spot underperforming assets early.

Reporting is not just about accountability—it’s how you find your next growth opportunity. With the right metrics in place and a commitment to ongoing analysis, financial institutions can market smarter, spend more efficiently, and get better results from every campaign they launch.

Geofencing and Programmatic Display Advertising

Getting in front of the right audience is essential, but getting in front of them at the right place and time? That’s where geofencing and programmatic display shine. Geofencing allows you to draw a digital perimeter around physical locations like competitor branches, car dealerships, or local real estate offices. Once a user enters that area, your ads can be triggered across the websites and apps they use. This strategy is especially powerful for loan products with location-based intent, such as auto loans, mortgages, or small business financing.

Programmatic display takes that approach even further, using real-time data like online behavior, demographics, and search intent to automate ad placements for optimal reach and relevance. Together, these tools help financial institutions go beyond broad targeting—and into precision marketing that meets borrowers in moments that matter.

Geofencing marketing and programmatic strategies that drive results:

- Set geo-fences around competitor banks or credit unions to serve timely “switch and save” loan offers.

- Target apartment complexes or home improvement stores with home equity loan ads.

- Use behavioral data to retarget users who started but didn’t finish a loan application.

- Layer in demographic and interest-based filters to fine-tune your audience even further.

- Schedule display ads to serve during peak mobile usage hours, like lunch breaks or evenings.

Geofencing and programmatic aren’t just buzzwords—they’re smart ways to stretch your budget and show up when intent is high. By combining physical context with digital signals, banks and credit unions can create loan campaigns that feel relevant, timely, and hard to ignore.

Leveraging Video Marketing for Loan Products

Video marketing is no longer optional in digital marketing—it’s expected. For financial institutions trying to explain complex products or build trust with new audiences, it’s one of the most effective tools available. A short, well-produced video can do what a wall of text never could: show emotion, simplify difficult topics, and make your brand feel human. Whether it’s a 30-second explainer about fixed-rate vs. variable loans, a testimonial from a satisfied borrower, or a quick walk-through of how to apply online, video builds understanding and credibility. Platforms like YouTube, Instagram, and TikTok make it easier than ever to reach people where they’re already scrolling. And when you consider how many consumers now prefer watching over reading, the case for video becomes even stronger.

Types of video content that resonate with borrowers:

- Explainer videos that break down loan products in simple, visual terms.

- Customer testimonials that showcase real people achieving real goals with your help.

- Behind-the-scenes clips that humanize your team and demystify the application process.

- Educational series for social platforms covering financial literacy basics.

- Video CTAs that guide viewers to calculators, applications, or contact forms.

A good video doesn’t just inform—it builds an emotional connection. When your audience can see themselves in your message, they’re more likely to trust you, engage with your brand, and take action when it’s time to borrow.

Omnichannel Marketing: Consistent Borrower Experiences

Borrowers don’t take a straight-line path to choosing a lender. They may click an Instagram ad in the morning, browse your website at lunch, read a review that evening, and finally open your email a day later. An omnichannel approach ensures that all of those touchpoints feel like one continuous conversation—not a series of disconnected promotions. When branding, messaging, and tone are aligned across platforms, it signals consistency and professionalism—two things borrowers look for when evaluating financial institutions.

Creating this level of cohesion takes more than matching colors and fonts. It means understanding the borrower journey from beginning to end, and designing content and campaigns that meet them at each stage with relevance. A well-integrated CRM, personalized automation, and regular audits can ensure a borrower doesn’t receive conflicting messages or redundant outreach. The result is a smoother experience that feels tailored rather than transactional—and borrowers notice that difference.

Ways to deliver a connected borrower journey:

- Use behavior-based triggers to customize messaging across email, social, and SMS.

- Sync your offers and visuals across paid media, organic posts, and landing pages.

- Conduct quarterly reviews of your borrower journey to identify friction points.

When all your digital channels work together, the borrower experience feels intentional and easy. That ease can be the difference between a bounced session and a submitted application.

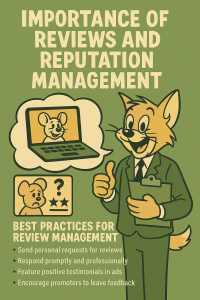

Importance of Reviews and Reputation Management

Before someone trusts your institution with a major financial decision, they want to know what others have experienced. That’s why online reviews have become one of the most powerful drivers of borrower behavior. Positive reviews reinforce confidence, while silence—or worse, unresolved complaints—can create hesitation. Managing your institution’s reputation means engaging with feedback openly and consistently, whether it’s glowing praise or a tough critique.

Actively encouraging reviews isn’t just about padding your rating—it’s about showing that real people are choosing, and benefiting from, your services. When you respond to feedback with empathy and professionalism, you demonstrate transparency and accountability. Potential borrowers notice how you treat others, especially when things don’t go perfectly. That kind of visibility can be more influential than even your best ad copy.

Best practices for review management:

- Follow up post-loan closing with a simple, personal review request via email or text.

- Monitor major review platforms weekly and assign ownership for timely responses.

- Feature standout reviews or client quotes in landing pages and retargeting ads.

- Use surveys to identify promoters and direct them to leave public reviews.

Your reputation is always on display, whether you manage it or not. Taking an active role shows prospective borrowers that you’re not just a lender—you’re a responsive, people-first organization they can count on.

Conclusion: Embrace Digital Transformation Today

Banks and credit unions committed to online loan marketing can effectively differentiate themselves in a competitive marketplace. Leveraging digital channels, strategic content, analytics-driven decisions, and regulatory compliance ensures sustained growth and borrower engagement.

Institutions ready to elevate their digital loan marketing should consider partnering with digital marketing experts like Propellant Media. Investing in digital transformation today positions your institution for sustained success, increased borrower satisfaction, and ongoing profitability.

Looking to elevate your digital loan marketing strategy? Contact Propellant Media for a free 30-minute demo tailored for financial services, mortgage providers, and banks. Discover how we can help you enhance your digital presence and boost profitability. Don’t miss this opportunity to transform your marketing approach!